Lift Fund

Small Business Administration

Find eligible SBA lenders here.

U.S. Department of Treasury

Paycheck Protection Program Loans: Frequently Asked Questions (FAQs)

Coronavirus Aid, Relief, and Economic Security Act

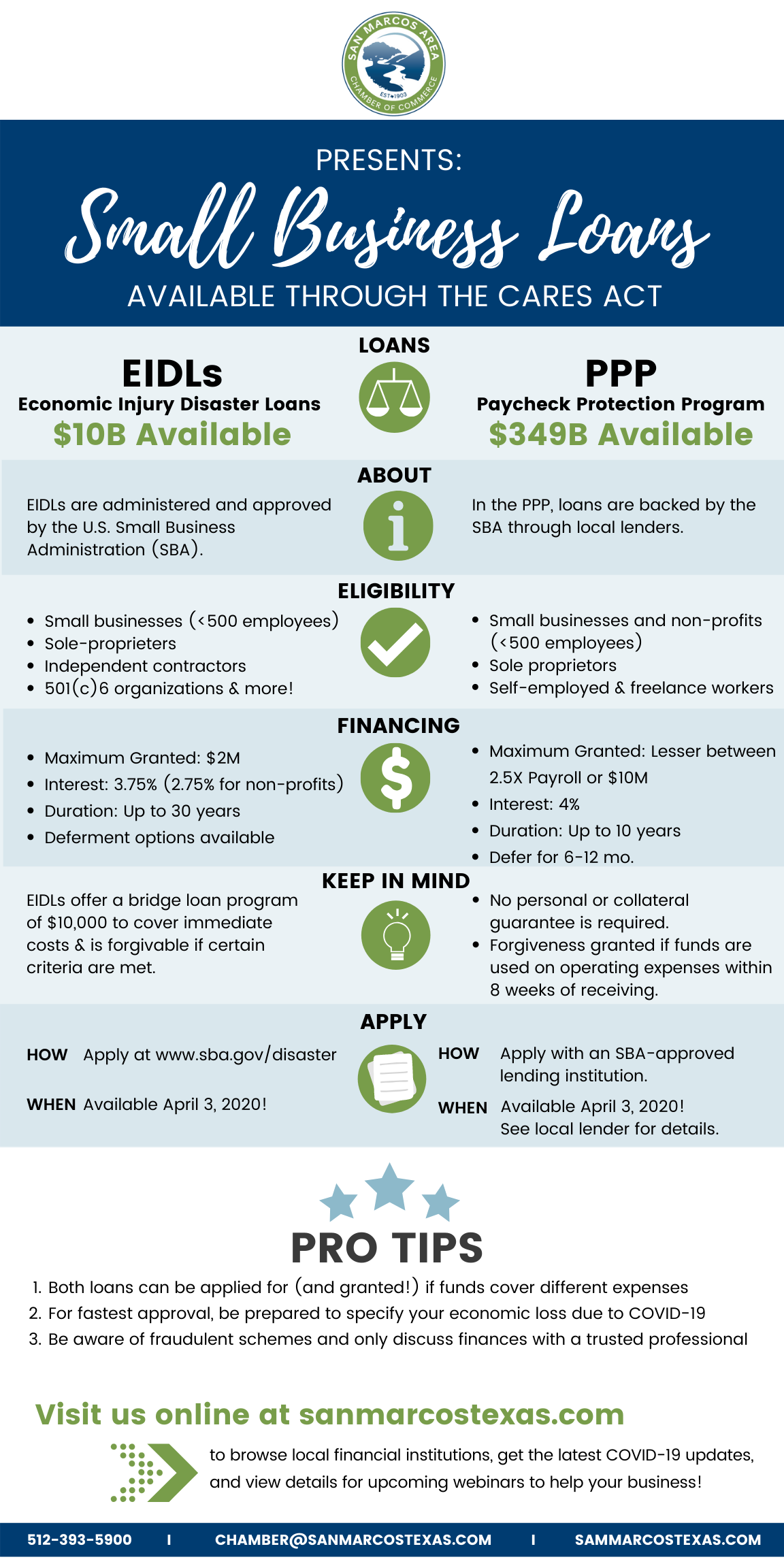

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program (PPP) the initiative provides 100% federally guaranteed loans to small businesses.

Importantly, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward.

The administration has released initial guidelines; they are available at www.treasury.gov. The U.S. Chamber of Commerce has issued this guide to help small businesses and self-employed individuals check eligibility and prepare to file for a loan.

Small businesses and sole proprietors can begin applying on April 3. Independent contractors and self-employed individuals can apply beginning on April 10.

Economic Injury Disaster Loans

The CARES Act expands the Small Business Administration’s long-standing Economic Injury Disaster Loan Program (EIDL). The EIDL program was created to assist businesses, renters, and homeowners located in regions affected by declared disasters.

Employee Retention Tax Credit

The CARES Act created a new employee retention tax credit for employers who are closed, partially closed, or experiencing significant revenue losses as a result of COVID-19

Side-by-Side Look at the PPP Loans and the EIDL Loans

Please know that you have a local team here to support you during this very difficult time. If you have any business questions as it relates to COVID-19, please contact us at 512-393-5900.